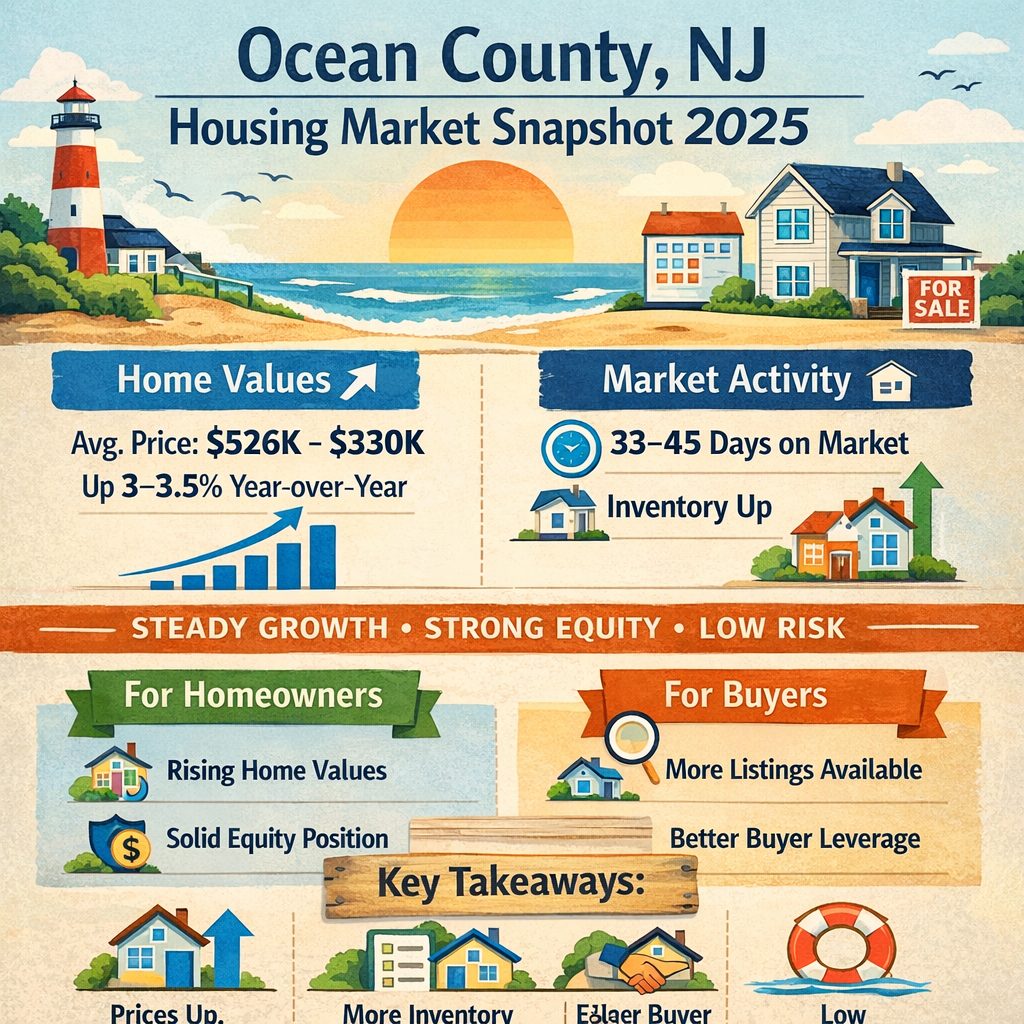

Ocean County, NJ Housing Market Update: Equity Remains Strong as the Market Normalizes

As national housing headlines point to slower price growth and shifting equity trends, Ocean County, New Jersey continues to show resilience. Recent home equity data indicates that while the U.S. market is cooling from historic highs, Ocean County homeowners remain in a solid equity position heading into 2026.

Strong Home Equity in Ocean County

Nationwide, homeowner equity eased slightly at the end of 2025 as price appreciation slowed. However, New Jersey has consistently ranked above the national average for equity-rich homes, and Ocean County largely reflects that strength.

Local price stability, combined with long-term ownership and conservative borrowing, has helped many Ocean County homeowners maintain significant equity — reducing the risk of widespread negative equity even as the market normalizes.

Home Prices: Moderating, Not Declining

Home values across Ocean County have continued to rise modestly, following years of rapid appreciation. While the pace of growth has slowed, prices remain elevated compared with pre-pandemic levels.

This moderation is a healthy sign. A more balanced market supports sustainable equity, reduces volatility, and creates better conditions for both buyers and sellers.

Inventory and Market Activity

Inventory levels in Ocean County have improved compared with the tight supply of recent years. Homes are taking slightly longer to sell, giving buyers more options and time to make informed decisions.

For sellers, this means pricing strategy and preparation matter more than ever — but strong equity positions give homeowners flexibility rather than urgency.

Underwater Mortgage Risk Remains Low

Nationally, the share of seriously underwater mortgages remains near historic lows. In Ocean County, rising values and steady demand suggest negative equity is not a widespread concern, particularly for long-term owners.

What This Means for Ocean County Homeowners and Buyers

-

Homeowners: Equity remains strong, providing financial flexibility and selling options.

-

Buyers: More inventory and a calmer pace offer better opportunities than during peak market conditions.

-

The Market: Ocean County is shifting toward balance — not decline.

Bottom Line

The Ocean County housing market is not weakening — it’s stabilizing. Strong equity, moderate price growth, and improving inventory point to a healthier, more sustainable real estate environment moving into 2026.

If you have questions about how these Ocean County housing trends affect your home’s value or your buying plans, connect with a Coldwell Banker Riviera Realty agent. Our local experts understand the data — and how it applies to your specific neighborhood.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link